When choosing pet insurance in 2025, you’ll want thorough coverage that protects against accidents, illnesses, and routine care. Look for plans with flexible reimbursement rates between 70-90% and manageable monthly premiums. Consider your pet’s age, breed, and health history when selecting a policy. Avoid plans with extensive exclusions, and prioritize providers offering hereditary condition coverage. Stick around, and you’ll uncover the top strategies for finding your perfect pet protection plan.

Key Takeaways

- Compare top pet insurance providers like Pets Best, Healthy Paws, and Nationwide for comprehensive medical coverage tailored to different pet needs and budgets.

- Prioritize plans offering extensive accident and illness coverage, with reimbursement rates between 70-90% and flexible deductible options to manage monthly expenses.

- Evaluate insurance plans based on breed-specific health risks, age considerations, and potential coverage for hereditary conditions and alternative therapy treatments.

- Select insurance that provides transparent policies regarding pre-existing conditions, waiting periods, and specific exclusions to avoid unexpected out-of-pocket veterinary expenses.

- Consider wellness add-ons and preventive care options that cover routine veterinary services, vaccinations, and annual check-ups for comprehensive pet healthcare protection.

Pet Health Insurance: A Veterinarians Perspective

As a pet owner navigating the intricate world of veterinary care, you’ll want to understand how pet health insurance can be a game-changer for your furry friend’s medical expenses. Insurance provides vital coverage for accidents, illnesses, and preventive care, potentially saving you thousands in unexpected veterinary bills. However, it’s essential to research plans carefully, as pre-existing conditions and specific coverage limitations can impact your policy’s effectiveness. Consulting with your veterinarian and comparing multiple plans will help you find the most extensive and cost-effective option for your pet’s unique health needs.

Best For: Pet owners seeking comprehensive medical coverage for their animals who want financial protection against unexpected veterinary expenses.

Pros:

- Covers accidents, illnesses, and preventive care, reducing out-of-pocket veterinary costs

- Provides peace of mind and ensures pets can receive necessary medical treatments

- Helps manage potentially expensive medical procedures and emergency interventions

Cons:

- Pre-existing conditions are typically excluded from coverage

- Ongoing premium increases can make long-term insurance less cost-effective

- Complex policy terms and coverage limitations may require extensive research to understand fully

https://www.amazon.com/dp/0982322143

Pet Insurance Buyers Guide for Dog and Cat Parents

Pet parents seeking extensive health coverage for their beloved dogs and cats will find the “Best Pet Insurance Plans of 2025” a vital guide to maneuvering the complex world of veterinary protection. This comprehensive resource offers pivotal insights into major pet insurers, providing detailed feature comparisons and addressing critical considerations like pre-existing conditions and congenital inclusions. With a user-friendly comparison chart, you’ll easily navigate policy options, helping you make an informed decision that meets your pet’s unique health needs and your financial constraints. Whether you’re researching for a paper or preparing to invest in your furry companion’s well-being, this guide is an irreplaceable tool.

Best For: Pet owners seeking comprehensive, detailed guidance on selecting the most appropriate and cost-effective pet insurance for their dogs and cats.

Pros:

- Provides extensive feature comparisons across multiple pet insurance providers

- Includes a user-friendly comparison chart for easy policy evaluation

- Addresses critical considerations like pre-existing conditions and congenital inclusions

Cons:

- May be overwhelming for those seeking a quick, simple overview

- Specific details might become outdated as insurance policies change

- Requires careful reading and research to fully utilize the guide’s information

https://www.amazon.com/dp/B0075OIZ9W

Pet Passport US: Pet Passport Health Records

Travelers and pet owners seeking an extensive health record solution will find the Pet Passport US: Pet Passport Health Records a practical tool for documenting their furry companion’s medical journey. Its well-marked sections accommodate shot records, doctors’ notes, microchip data, and a pet photo, with a dedicated space for rabies vaccination documentation. While the passport serves travel licensing needs, it has limitations. Users note the document’s large size makes it cumbersome for international travel, and the print quality appears blurry. Despite these drawbacks, the passport consolidates critical pet health information in one convenient booklet.

Best For: Pet owners who need a comprehensive health record booklet for their pets, especially those planning domestic or limited international travel.

Pros:

- Provides a centralized location for all pet health records

- Includes dedicated sections for shot records, microchip data, and pet photo

- Convenient for tracking medical history and vaccination information

Cons:

- Passport is oversized and difficult to carry while traveling

- Print quality is blurry and appears unprofessional

- Less comprehensive compared to European pet passport standards

https://www.amazon.com/dp/1539363759

Cost-Effective Pet Care Guide for Pet Owners

Budget-conscious pet owners seeking exhaustive financial guidance will find the “Cost-Effective Pet Care Guide” an invaluable resource in maneuvering the complex landscape of pet ownership expenses. The book offers practical insights into insurance, traveling, and budgeting strategies, complemented by charming cartoon characters and helpful charts. With detailed tips, pet food recipes, and a QR code providing free resources, this all-encompassing guide equips you with the knowledge to provide excellent care without straining your wallet. Whether you’re a current or prospective pet owner, this well-researched book delivers humor and actionable advice for financially savvy pet care.

Best For: Budget-conscious pet owners looking for comprehensive financial guidance on pet care and ownership.

Pros:

- Provides practical insights into pet-related expenses with detailed tips and strategies

- Includes bonus features like pet food recipes and a QR code with free resources

- Written in a humorous and engaging style with helpful charts and cartoon characters

Cons:

- May be too detailed for casual pet owners

- Requires time to read and implement all recommended strategies

- Some advice might not apply to all pet types or individual situations

https://www.amazon.com/dp/B0DDFH366J

Dog Toy Insurance 3 Month Protection Plan (9.99-19.99)

Dog owners who cherish their furry friends’ playtime will find the Dog Toy Insurance 3 Month Protection Plan a game-changer, especially if you’re tired of constantly replacing destroyed toys. Covering new dog toys priced between $9.99 and $19.99, this hassle-free plan guarantees a refund, replacement, or exchange if your pup obliterates their favorite plaything within three months. With a simple online claims process requiring photo verification, you’ll protect your investment and safeguard continuous entertainment for your canine companion. While normal wear and tear aren’t covered, this minority-owned, American-based company offers peace of mind for pet parents seeking cost-effective toy protection.

Best For: Dog owners who want financial protection for their dog toys and are tired of repeatedly purchasing new toys after their pets destroy them.

Pros:

- Hassle-free online claims process

- Covers toys between $9.99-$19.99 for 3 months

- Offers refund, replacement, or exchange options

Cons:

- Does not cover normal wear and tear

- Limited to specific toy price range

- Requires photo verification for claims

https://www.amazon.com/dp/B0DS92JJR8

Best Way to Get a Pet Insurance Quote

When searching for the right pet insurance quote, pet owners will discover multiple efficient methods to compare coverage and pricing. Start by researching online providers, utilizing comparison websites that aggregate quotes from different companies. Request quotes directly from top insurers, providing detailed information about your pet’s age, breed, and health history. Consider consulting with veterinarians or pet owners for recommendations. Compare deductibles, coverage limits, and exclusions carefully. Don’t rush the process; take time to understand each policy’s specifics and guarantee it meets your pet’s unique healthcare needs.

Best For: Pet owners seeking comprehensive and affordable insurance coverage who want to thoroughly research and compare multiple options before making a decision.

Pros:

- Allows comparison of multiple insurance providers through online resources and comparison websites

- Provides opportunity to gather detailed quotes tailored to specific pet’s age, breed, and health history

- Enables consultation with veterinarians and other pet owners for personalized recommendations

Cons:

- Can be time-consuming to research and compare multiple insurance options

- May require detailed personal and pet health information during quote process

- Potential for overwhelming amount of information and policy variations

https://www.amazon.com/dp/B009F161PI

What is Pet Insurance: Is it Worth the Price Reviews and Comparison

Pet owners seeking financial protection against unexpected veterinary expenses will find detailed insights into the evolving landscape of pet insurance. With rising medical costs, these plans can shield you from hefty bills during medical emergencies. Coverage typically includes accidents, illnesses, and sometimes routine care, depending on your selected plan. Premiums vary based on factors like pet age, breed, and health history. While costs range from $30 to $70 monthly, the potential savings during critical medical situations can far exceed your investment. Carefully compare providers, examining their reimbursement rates, deductibles, and exclusions to find the most suitable protection for your furry companion.

Best For: Pet owners seeking financial protection against unexpected veterinary expenses and looking to manage potential high medical costs for their pets.

Pros:

- Provides financial coverage for accidents, illnesses, and sometimes routine veterinary care

- Helps mitigate potentially expensive medical emergencies

- Offers peace of mind and predictable monthly expenses for pet healthcare

Cons:

- Monthly premiums can be costly, ranging from $30 to $70

- Some plans have extensive exclusions and limitations

- Pre-existing conditions are typically not covered by most insurance providers

https://www.amazon.com/dp/B06WWQ32ZN

Frienda Car Registration and Insurance Card Holder Organizer

Drivers seeking a reliable solution for organizing essential vehicle documents will find the Frienda Car Registration and Insurance Card Holder Organizer an exceptional choice. Crafted from durable PU leather and PVC, this two-piece set offers waterproof protection for your important papers. Its magnetic closure guarantees documents stay secure, while the hypotenuse design allows easy access to your driver’s license. With inner pouches for quick identification and a sleek appearance in black or brown, this organizer keeps your car paperwork neatly arranged and protected from wear and tear. At just 8.4 ounces, it’s a lightweight, practical solution for document management.

Best For: Drivers who want a compact, secure, and organized way to store and protect their vehicle registration, insurance, and personal identification documents.

Pros:

- Waterproof and durable construction made from high-quality PU leather and PVC

- Magnetic closure prevents documents from falling out

- Convenient hypotenuse design for easy document retrieval

Cons:

- Limited color options (only black and brown)

- Only suitable for storing flat documents

- Manufactured in China, which might concern some buyers seeking domestic products

https://www.amazon.com/dp/B08S79DNG8

Funny Coffee Mug for Insurance Sales Agent Graduation Gift

Insurance sales agents deserve recognition for their hard work, and what better way to celebrate their achievements than with a humorous coffee mug that speaks volumes? This white ceramic mug, featuring the quote “Best Insurance Sales Agent Ever”, is a practical and witty gift perfect for graduation or any special occasion. Made in the USA, the 15oz mug is microwave and dishwasher safe, ensuring durability and ease of use. With its classic style and handle, it’ll bring a smile to any insurance professional’s face while serving as a daily reminder of their accomplishments.

Best For: Insurance sales agents, recent graduates, and professionals looking for a humorous and functional gift to celebrate their achievements.

Pros:

- Microwave and dishwasher safe for easy maintenance

- Made in the USA with a classic design

- Witty quote that celebrates professional accomplishments

Cons:

- Limited to white color option

- Specific to insurance sales profession

- Humor may not appeal to everyone

https://www.amazon.com/dp/B0FDW79WP9

Insurance Sales Agent Funny Coffee Mug Gift for Father’s Day

Looking to nail the perfect Father’s Day gift for an insurance sales agent with a sense of humor? This black coffee mug delivers laughs and love with its bold quote: “Insurance Sales Agent By Day, Worlds Best Dad By Night.” Made of high-quality ceramic and microwave-safe, it’s a conversation starter that’ll make any insurance pro smile. Whether you’re a family member, coworker, or friend, this unique gift celebrates dad’s professional hustle and parenting prowess. Order now and turn Father’s Day into a memorable, humor-filled celebration that shows just how much you appreciate him.

Best For: Insurance sales professionals who love a good laugh and appreciate thoughtful, humor-filled gifts that celebrate both their career and fatherhood.

Pros:

- High-quality ceramic construction that is microwave and dishwasher safe

- Unique, humorous design that serves as a conversation starter

- Perfect gift for multiple occasions including Father’s Day, birthdays, and work celebrations

Cons:

- Limited appeal to those without a sense of humor about their profession

- Specifically targeted to insurance sales agents, which narrows the potential gift recipient pool

- Might be seen as a novelty item with limited long-term use

https://www.amazon.com/dp/B0F84M8FWT

Insurance Sales Agent Funny Camping Mug for Dad

Dads who sell insurance deserve a chuckle-worthy moment during their daily grind, and this 12 oz camping mug perfectly captures their dual identity. With its witty quote “Insurance Sales Agent By Day, Worlds Best Dad By Night,” the stainless steel mug celebrates the professional and personal sides of hardworking insurance agents. The enamel-finished drinkware features permanent printing that won’t fade, making it a sturdy companion for hot coffee or tea. Whether it’s Father’s Day or just another appreciation moment, this humorous gift will bring a smile to your dad’s face.

Best For: Hardworking insurance sales agents who appreciate a touch of humor and want to celebrate their professional and parental roles.

Pros:

- Unique, thoughtful gift that combines professional identity with fatherhood

- Durable stainless steel construction with permanent printing

- Versatile 12 oz capacity suitable for various hot beverages

Cons:

- Limited appeal to those outside the insurance sales profession

- Specific humor may not resonate with all recipients

- Potentially niche gift that requires understanding of insurance sales culture

https://www.amazon.com/dp/B0F87SRMRW

ALAZA Car Registration and Insurance Card Holder for Vehicle Documents

For organized drivers who value document preservation, the ALAZA Car Registration and Insurance Card Holder emerges as a streamlined solution to vehicular paperwork chaos. Crafted from durable PVC leather, this large paisley-patterned organizer offers multiple pockets to secure your essential documents. You’ll appreciate its smart design: one main pocket for car insurance, two for registration, and three smaller slots for additional cards. Measuring 9.45″ when unfolded, it fits conveniently in your glove box, ensuring your paperwork stays tidy, accessible, and protected. With Amazon’s 30-day return guarantee, you can confidently invest in this practical document management tool.

Best For: Drivers who prioritize document organization and quick access to vehicle paperwork in their glove compartment.

Pros:

- Multiple specialized pockets for various document types

- Compact and portable design that fits easily in a glove box

- Durable PVC leather material for long-lasting protection

Cons:

- Limited to one color/pattern option

- May be slightly bulky for minimalist vehicle storage

- Requires manual organization and maintenance of documents

https://www.amazon.com/dp/B0DF21N8ZL

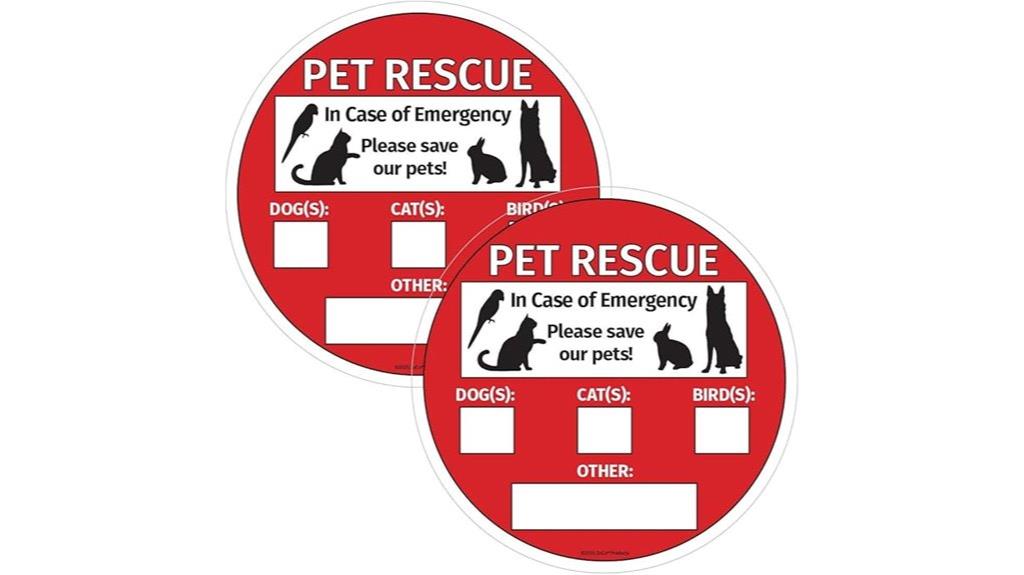

Safety Magnets Emergency Pet Rescue Window Sign (2 Pack)

Pet owners seeking an additional layer of safety for their furry companions will appreciate the Safety Magnets Emergency Pet Rescue Window Sign. These 5×5-inch static cling stickers alert first responders about pets inside your home during emergencies. Designed for interior window application, they can’t be tampered with from outside and allow you to customize the number and types of pets present. Made in the USA, these red round signs provide vital information that could save your dog, cat, rabbit, or bird’s life during a critical situation.

Best For: Pet owners who want to ensure emergency responders are aware of their pets’ presence in case of a fire or other home emergency.

Pros:

- Easy to apply static cling design that removes cleanly without residue

- Customizable to indicate number and types of pets

- Made in the USA with clear, visible emergency rescue information

Cons:

- Limited to interior window placement

- Only comes in red color

- Relatively small 5×5 inch size may not be highly visible from a distance

https://www.amazon.com/dp/B084VGM5ZT

Factors to Consider When Selecting Pet Insurance

When choosing pet insurance, you’ll want to closely examine coverage options that protect your furry friend’s specific health needs. Consider how pre-existing conditions might limit your policy, and weigh the balance between monthly costs and all-inclusive protection. Your strategy should also factor in claim reimbursement rates and annual deductible structures to guarantee you’re getting the most value for your pet’s healthcare investment.

Coverage Options Matter

Three essential coverage options can make or break your pet insurance decision. Accident and illness coverage protects your pet from unexpected medical emergencies, surgical procedures, and chronic conditions. Extensive plans typically include diagnostic tests, treatments, and prescription medications.

Wellness coverage adds preventative care benefits, covering routine check-ups, vaccinations, and annual screenings. This option helps manage your pet’s ongoing health maintenance costs and can save you money in the long run.

Optional add-ons like hereditary condition coverage and alternative therapy treatments provide additional protection for breed-specific health risks. You’ll want to carefully evaluate these options based on your pet’s breed, age, and potential health vulnerabilities. Matching the right coverage to your pet’s specific needs guarantees comprehensive financial protection and peace of mind.

Pre-Existing Condition Limits

Understanding pre-existing condition limits can substantially impact your pet insurance selection process. These limitations often exclude coverage for health issues your pet already has, potentially leaving you with significant out-of-pocket expenses.

Different providers define pre-existing conditions uniquely, which means even minor past health incidents could disqualify your pet from extensive coverage. This makes it vital to carefully review policy details before committing. Most insurers impose waiting periods ranging from 6-12 months before coverage begins, further complicating your options.

To optimize your insurance benefits, consider enrolling your pet when they’re young and healthy. This strategy helps guarantee broader coverage and reduces the risk of pre-existing condition exclusions. By being proactive and informed, you’ll make a more strategic insurance choice that protects your furry friend’s long-term health.

Cost Versus Protection

Maneuvering the delicate balance between cost and protection becomes essential when selecting the right pet insurance plan for your furry companion. You’ll want to weigh monthly premiums against potential veterinary expenses, considering that unexpected care can range from $500 to $5,000.

Your plan’s deductible directly impacts your monthly costs. Choosing a higher deductible ($500-$1,000) typically reduces your premium, while a lower deductible means higher monthly payments. Reimbursement rates between 60% and 90% further influence your out-of-pocket expenses. Remember that your pet’s age, breed, and health history will affect coverage options and pricing.

Ultimately, the goal is finding a plan that provides thorough protection without breaking the bank.

Claim Reimbursement Rates

When choosing pet insurance, claim reimbursement rates play a critical role in determining your overall financial protection. Most plans will reimburse between 70-90% of covered veterinary expenses, but the exact percentage depends on your selected plan and premium.

You’ll want to carefully examine how different insurers structure their reimbursement options. Some allow you to choose higher reimbursement rates by paying higher monthly premiums. Additionally, wellness and preventive care expenses might have more favorable reimbursement percentages compared to accident and illness claims.

Consider how deductibles will impact your final reimbursement amount. A lower deductible often means a higher monthly cost but potentially greater financial relief when filing claims. By comparing these factors across multiple pet insurance providers, you’ll find the most suitable coverage for your furry friend’s healthcare needs.

Annual Deductible Strategies

After examining reimbursement rates, pet owners must next evaluate annual deductible strategies that directly impact their insurance costs and coverage. Your choice of deductible can considerably affect monthly premiums and out-of-pocket expenses.

Higher deductibles like $500 or $1,000 lower monthly payments but increase your financial responsibility during claims. Conversely, lower deductibles around $100 or $250 provide more extensive coverage with higher premiums. The key is balancing affordability with expected veterinary needs.

Consider your pet’s health, age, and potential medical risks when selecting a deductible. Some plans offer per-condition or annual reset options, which can further influence your overall insurance strategy. Carefully assess these factors to find the most cost-effective coverage for your furry companion.

Breed-Specific Health Considerations

Because not all pets are created equal, selecting the right pet insurance requires understanding breed-specific health risks that can considerably affect long-term veterinary expenses. Brachycephalic breeds like Pugs and French Bulldogs demand specialized respiratory coverage, while large dog breeds need thorough orthopedic protection for potential joint issues.

Certain breeds carry genetic predispositions that directly impact insurance selection. Dachshunds, for instance, are prone to intervertebral disc disease, which could necessitate expensive spinal surgeries. Persian cats have heightened risks of polycystic kidney disease, a condition that might be excluded from standard plans.

When choosing pet insurance, carefully evaluate your breed’s unique health vulnerabilities. Researching breed-specific conditions and selecting tailored coverage can save you significant money and provide peace of mind throughout your pet’s lifetime.

Frequently Asked Questions

Does Pet Insurance Cover Pre-Existing Conditions?

Most pet insurance plans won’t cover pre-existing conditions. If your pet was diagnosed with a health issue before purchasing the policy, you’ll likely be out of pocket for related treatments. However, some insurers might offer coverage for curable conditions after a waiting period or if your pet has been symptom-free for a specific time. It’s essential to carefully review policy details before making a decision.

How Quickly Can I Get Reimbursed for Veterinary Expenses?

Rapidly resolving reimbursement requests, most pet insurance providers process claims within 5-10 business days. You’ll typically submit your veterinary invoice online or via mobile app, and once approved, you’ll receive payment through direct deposit or check. The speed depends on your specific plan and the completeness of your claim documentation. Don’t forget to include all necessary receipts and medical records to expedite your reimbursement.

Can I Use Any Veterinarian With My Pet Insurance?

Most pet insurance plans let you use any licensed veterinarian you choose. You’re not restricted to a specific network, giving you the flexibility to visit your preferred vet or seek specialized care. Just pay the vet bill upfront, then submit your claim for reimbursement. Some plans even cover emergency care and treatments abroad, ensuring your pet gets the care they need wherever you are.

Are Routine Check-Ups and Preventive Care Included in Coverage?

Most pet insurance plans don’t automatically cover routine check-ups and preventive care in standard policies. You’ll want to look for wellness or preventive care add-ons that cover annual exams, vaccinations, and routine screenings. These optional riders typically cost extra but can help manage your pet’s regular healthcare expenses. Always review the specific details of each plan to understand exactly what’s included in preventive care coverage.

What Happens if I Cancel My Pet Insurance Policy?

If you cancel your pet insurance policy, you’ll immediately lose coverage for any future veterinary expenses. Your existing claims won’t be reimbursed, and any ongoing treatments won’t be covered. You’ll be responsible for all medical costs moving forward. Some insurers might charge a cancellation fee, so it’s wise to review your specific policy terms before making a final decision.

Conclusion

You’ve navigated the wild jungle of pet insurance like a seasoned explorer, dodging financial predators and sniffing out the best coverage. Your furry companion will thank you—no more panic attacks over unexpected vet bills or dramatic fainting spells when the invoice arrives. Remember, choosing the right plan isn’t just smart; it’s your ticket to pet parental peace of mind. Your wallet and your four-legged friend will applaud your detective work.

Maria is brilliant when it comes to creating beautiful and functional spaces. Maria has an exceptional ability to understand your needs and desires, translating them into tailored solutions that reflect your personality and lifestyle. Whether you’re seeking advice on home decor, looking to upgrade your interior, or seeking inspiration to enhance your quality of life through design, Maria can help you achieve your goals. With Maria by your side, your vision for the perfect home is within reach.